The bear mauling will continue until the macro situation improves. This week officially kicks off tech earnings season with about $7T in big tech market cap reporting before Friday together with several important macro data releases. The result will likely be a continued slide in tech stocks as potential escalation in the Iran-Israel conflict looms over the market.

The TLDR

A quick overview before we dive into the details of this week's Tech Pulse.

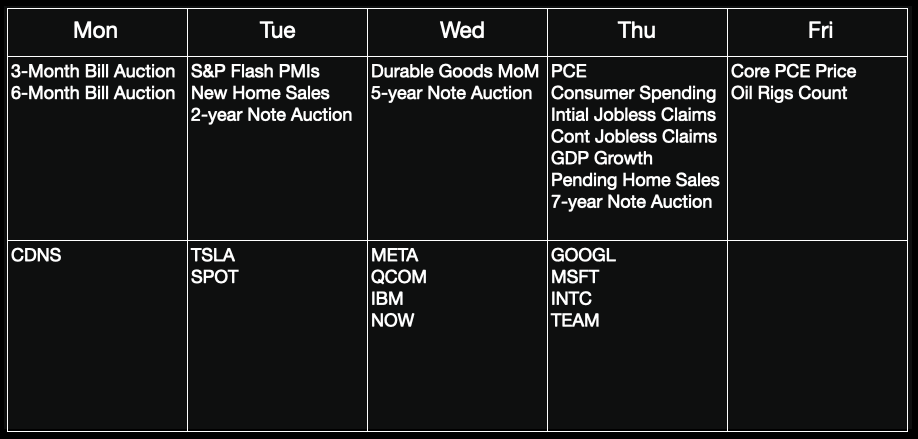

Macro:

- S&P Flash PMIs on Tuesday expected to suggest slowing growth across most industries

- PCE on Thursday expected to come in a little hot

- Overall, expecting a deceleration and possible beginning of a contraction in GDP with higher inflation expectations

Positioning:

- GDP momentum continues to slow into Q2

- Potential for negative earnings surprises and/or lowered guidance

- Negative outlook for tech stocks, but not yet clear evidence of a larger contraction in GDP

- Federal government in stimulus mode while the Fed tries to control inflation, strengthening the case for a more prolonged shift to stagflation

- Last week saw accelerated deleveraging and a shift toward risk-off across equities, with precious metals and defensive industries gaining

Earnings:

- Tesla:

- I expect a potential surprise in the upcoming earnings report

- Tesla may be preparing to pivot away from manufacturing automobiles

- Microsoft:

- Strong quarter expected, driven by AI integration in Microsoft 365 and Copilot

- Azure growth and Activision Blizzard acquisition to contribute positively

- Guidance is a risk due to weakening macro environment

- Price target of $478, slightly higher than the median consensus estimate

- Meta:

- Metaverse strategy has largely been a failure to date

- Open-sourcing initiatives in VR (Quest 3) and AI (Llama-3) show promise

- Potential threat to Google's core business with AI-augmented search

- Risk to revenue, earnings, and guidance due to weaker macro

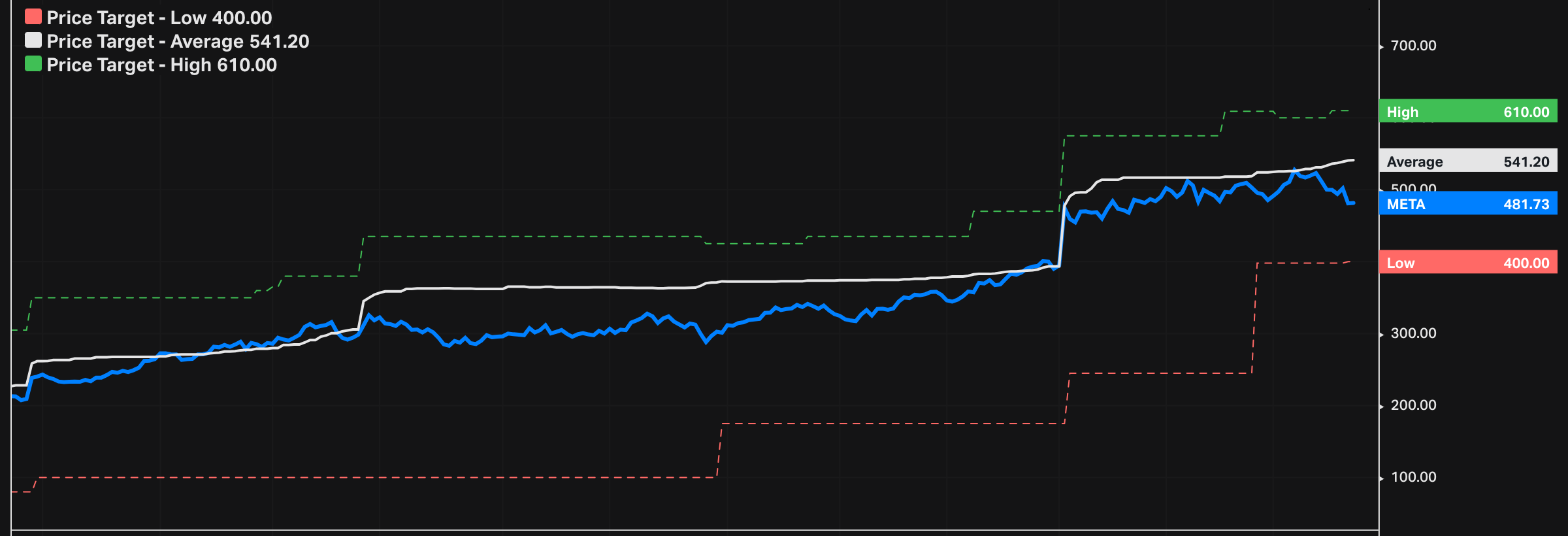

- Price target of $541, higher than the street consensus median of $481

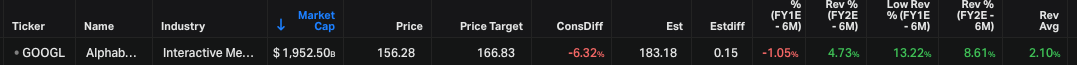

- Alphabet:

- Significant technical advantages in AI, but execution challenges and potential threats to core search business

- Internal challenges and bias in AI implementations raise concerns

- Commitment to strategic AI development remains

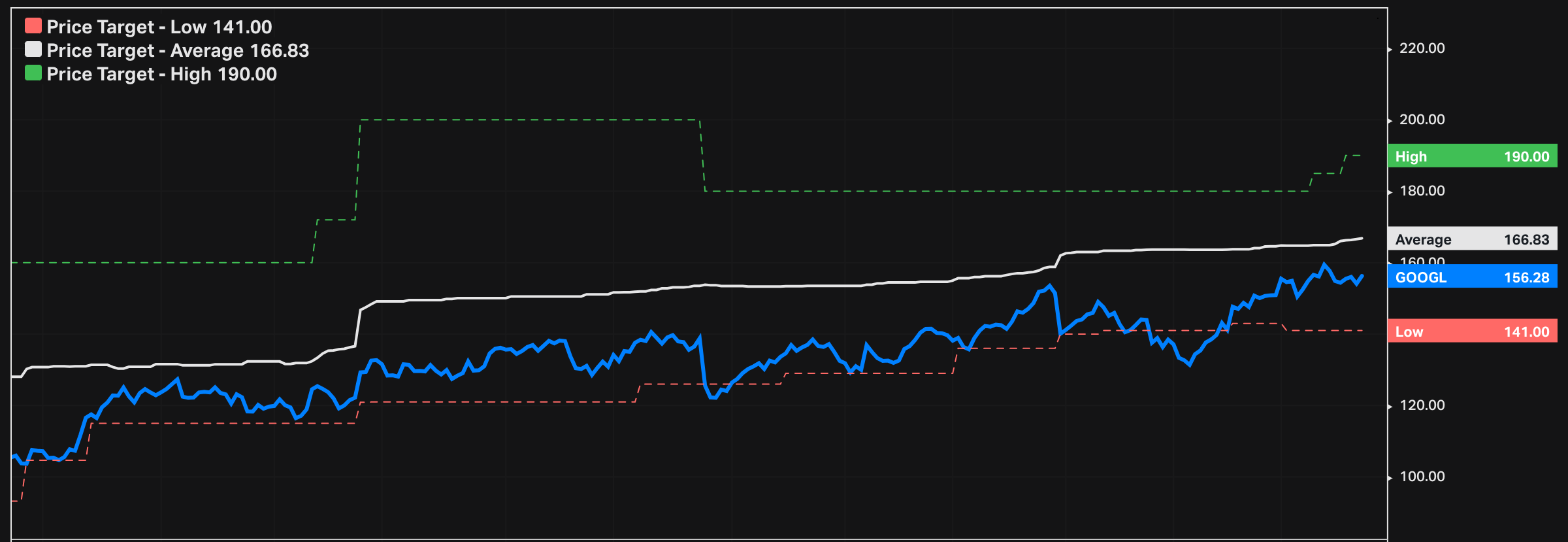

- Conservative outlook for Q1 2023 due to slowdown in search revenue growth

- Expect the earnings report to be within the expected move of +/- 5%

- Longer-term price target of $183, higher than the street consensus median of $166

- Spotify:

- Strong growth in Q4 2023, with increases in MAU, premium subscribers, and revenue

- Emphasis on profitability and efficiency, with successful expansion into audiobooks and near-profitable podcast segment

- Positive outlook for the upcoming earnings, with detailed guidance provided

- Small spread position targeting a move of +5% or -7%, with a target of $284-$295

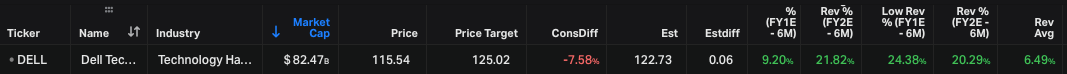

- Dell:

- Strong financial performance in FY '24 and optimism for FY '25

- Capitalizing on AI market growth, with consistent growth in traditional server sectors and AI-optimized servers

- Potential for further upside revisions due to recent developments in Google SLMs and Meta's Llama-3

- Current price target of $115 already achieved, but closely monitoring for evidence of AI projects moving forward this quarter

Macro

This week features several catalysts with S&P Flash PMIs on Tuesday, followed by Durable Goods on Wednesday, and PCE and Jobless Claims on Thursday. I expect the Flash PMIs will suggest slowing growth across most industries, and PCE will come in a little hot.

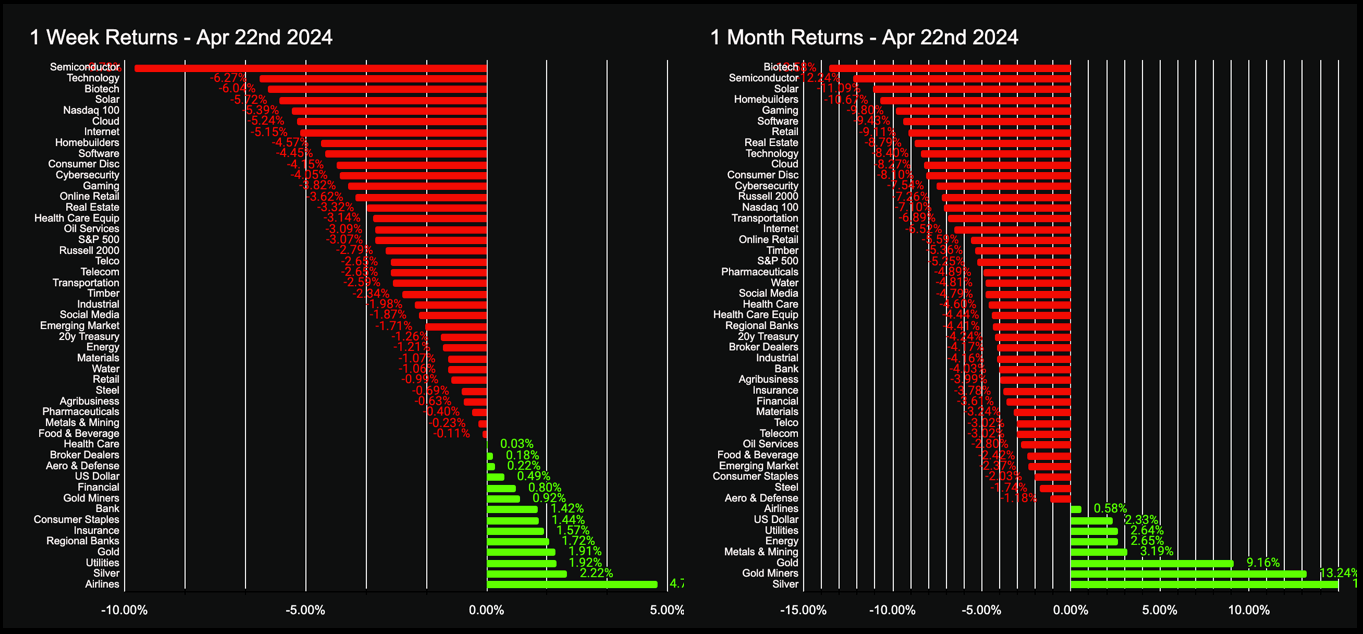

Market

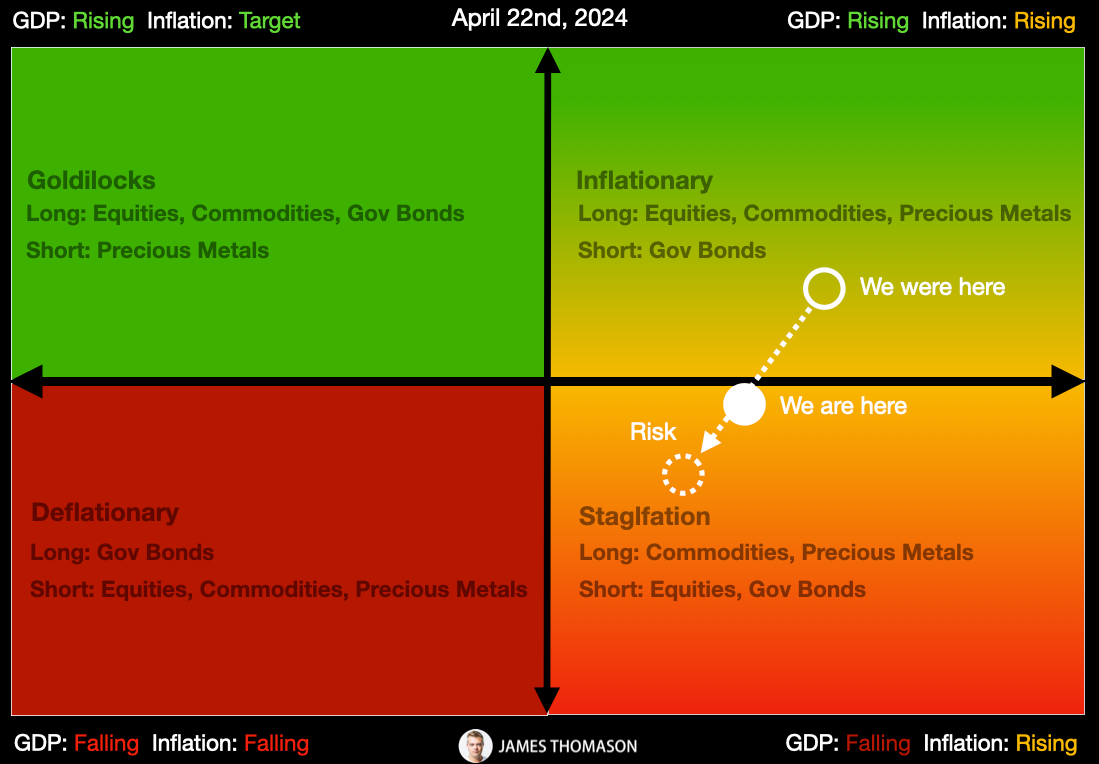

Overall last week accelerated deleveraging and a shift toward risk-off across equities as precious metals and defensive industries gained. This aligns with our view of a deceleration and possible beginning of a contraction in GDP with higher inflation expectations.

Positioning

My view remains unchanged: GDP momentum continues to slow into Q2, with the potential for negative earnings surprises and/or lowered guidance, which is overall a negative outlook for tech stocks. This is a "weak short" thesis as there is not yet clear evidence of a larger contraction in GDP. Further, as discussed in last week's Tech Pulse, we have the federal government in stimulus mode even as the Fed tries to control inflation. This strengthens the case for a more prolonged shift to stagflation.

Tech Pulse

Big tech companies navigate a challenging macro environment while leveraging AI for growth:

- Tesla faces negative news and revisions, hinting at a potential strategic shift.

- Microsoft rides strong AI integration and gaming acquisition tailwinds.

- Meta's open-source initiatives in VR and AI show promise despite metaverse struggles.

- Alphabet grapples with execution challenges and AI bias concerns while committing to AI development.

- Spotify demonstrates solid growth and profitability, with a positive outlook for the upcoming quarter.

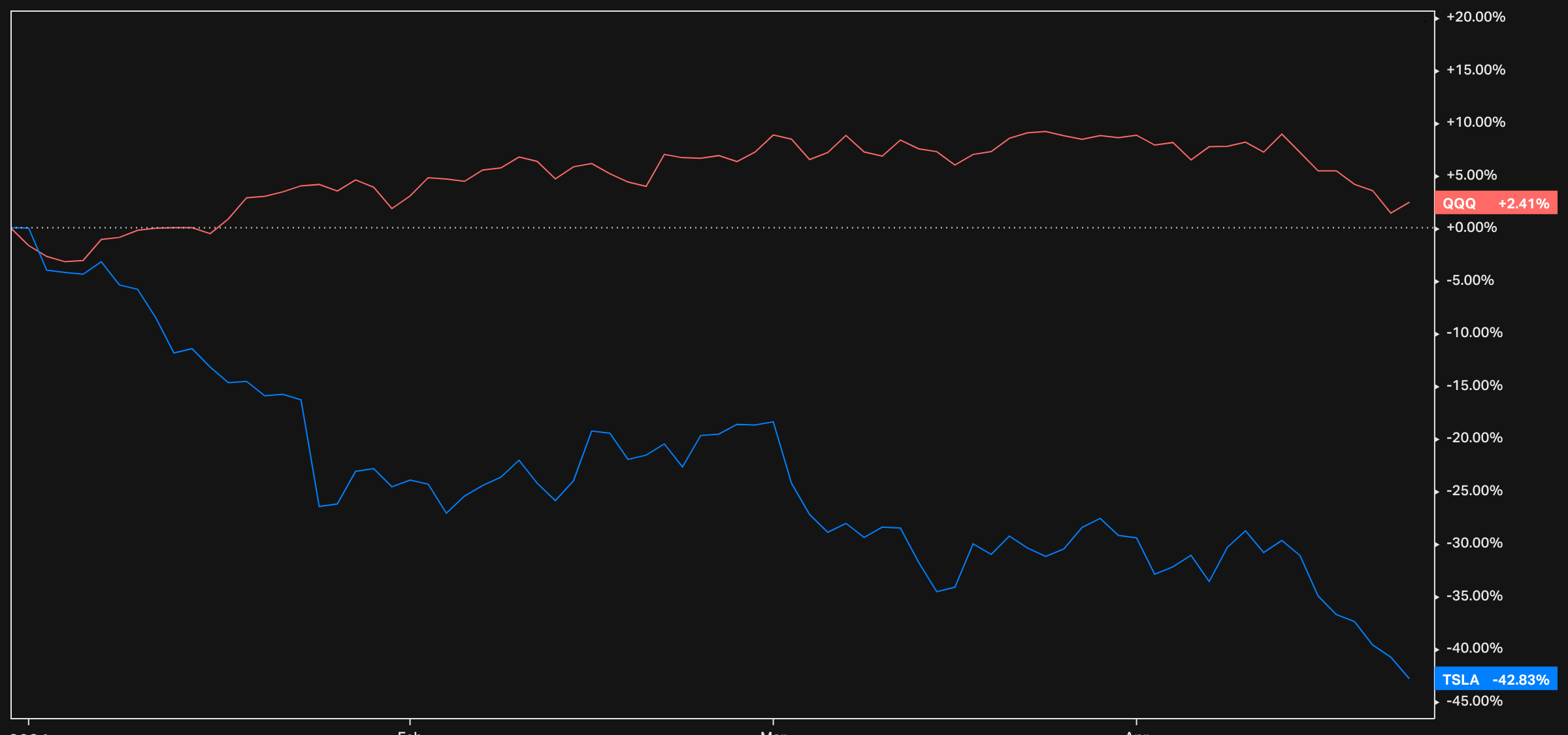

Tesla (TSLA)

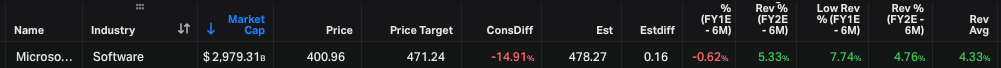

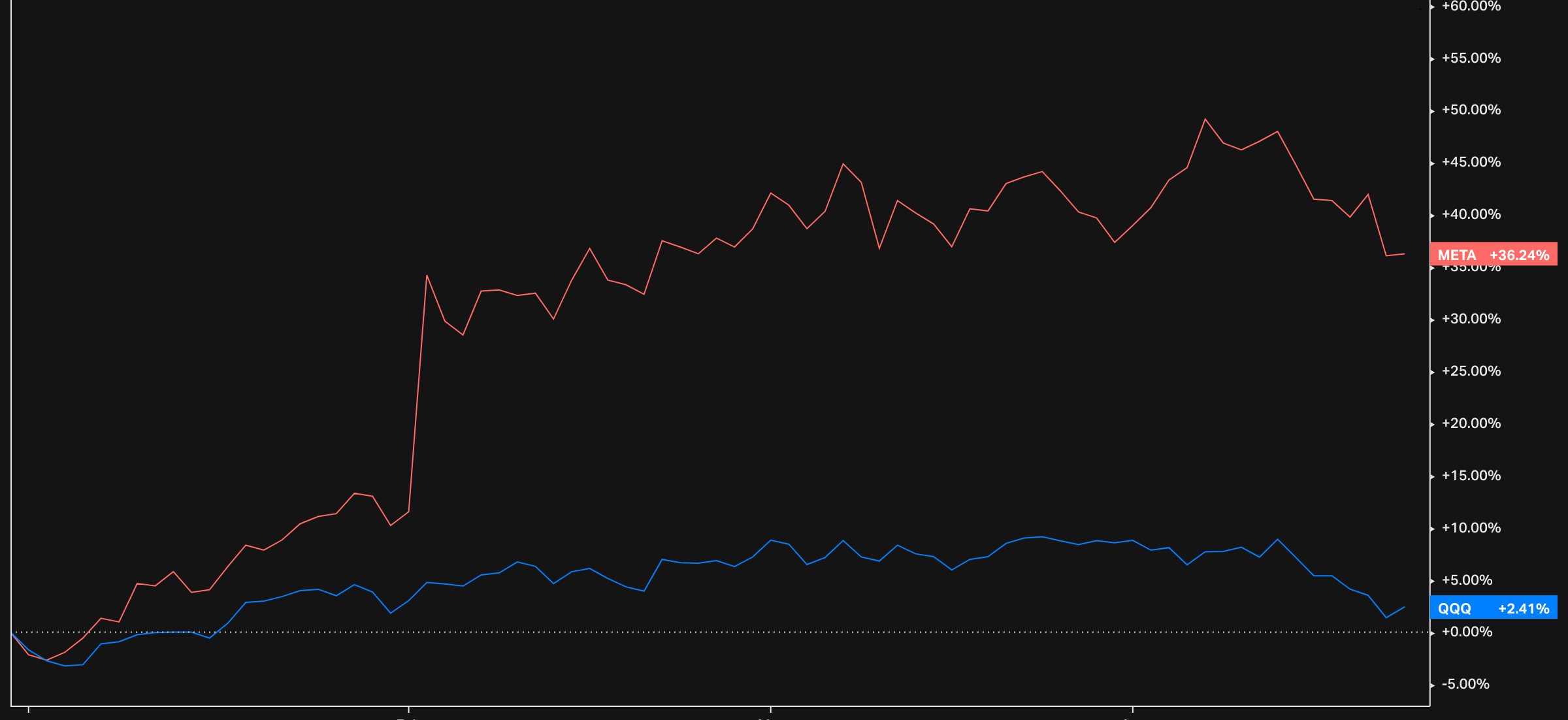

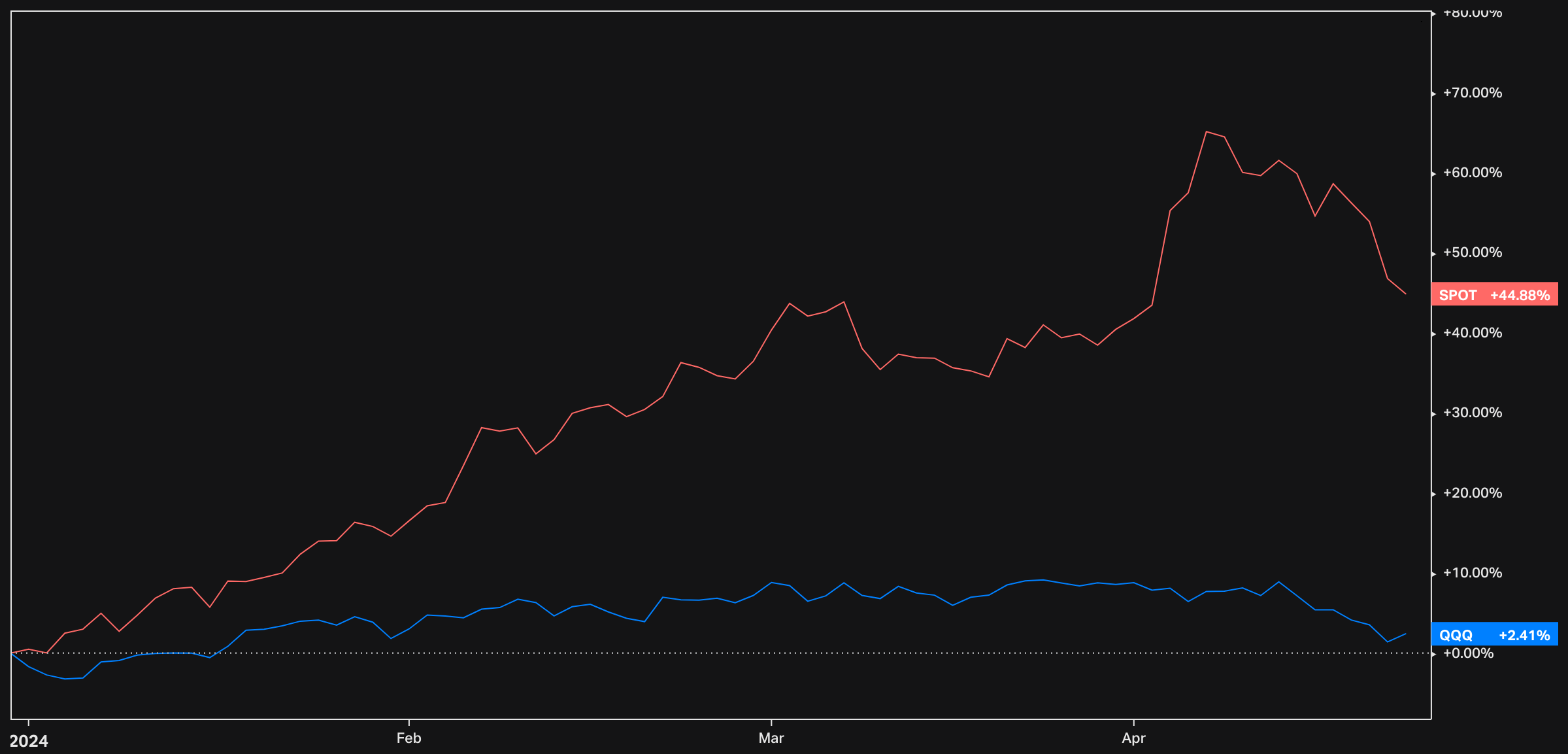

Unless you have been... asleep at the wheel... you already know Tesla stock is down -42% vs the Nasdaq clinging to a 2.41% return YTD.

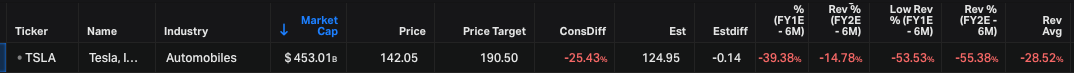

I have much to say in tomorrow's article about Tesla before the company reports after market. For now, suffice it to say there has been little else but a string of consistently negative news, together with negative revisions to estimated F1E and F2E sales and earnings:

In case you missed it:

- Elon Musk cancels trip to India over 'heavy Tesla obligations'

- Exclusive: Tesla scraps low-cost car plans amid fierce Chinese EV competition

- Tesla guts newly formed marketing team despite investors demanding greater focus on ads as EV sales slow

- Tesla Started Laying Off 14000 Employees. It Couldn't Have Gone Worse

- SAP removes Tesla from list of company car suppliers

Takeaways

It's hard to see how Elon cancels his much anticipated trip to India to work on a stellar earnings report, so that certainly seems to suggest a surprise might be on deck, but there's a chance it might not be the surprise we think. I think Tesla is preparing for the pivot away from manufacturing automobiles - more on that tomorrow.

Microsoft ($MSFT)

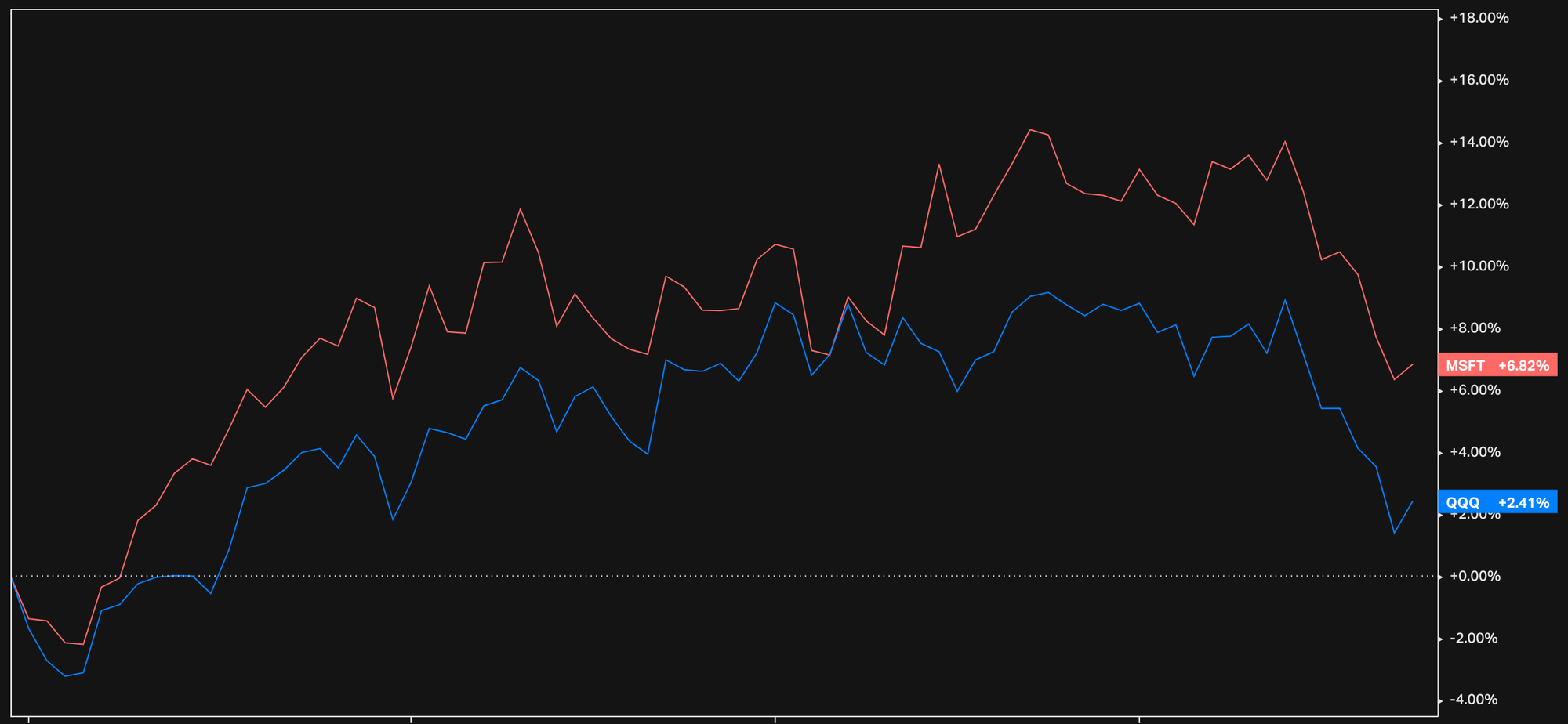

Microsoft continues to win this round of AI as it frantically incorporates features into Copilot and other products, we are long into earnings this week.

- Microsoft 365 and Copilot Expansion: Microsoft's Microsoft 365 suite is experiencing strong growth with by the addition of services like Copilot. The company last quarter reported ongoing demand, double-digit growth in seat counts and pricing, indicating a powerful user base and expanding market reach. This suggests the upcoming earnings could see a continued upward trajectory, particularly as Microsoft emphasizes AI integration and new capabilities in Microsoft 365.

- Azure Growth: Azure is gaining market share, powered by its AI capabilities and expanding service offerings. Azure's AI services were noted as a significant contributor to its revenue growth, highlighting strong customer adoption and increased usage of AI technologies. This trend is expected to positively impact the upcoming earnings.

- Activision Blizzard Acquisition: The integration of Activision Blizzard is set to enhance Microsoft's gaming segment, which might be a notable contributor to revenue in the upcoming report. Given the growth in gaming and content services, the Activision Blizzard acquisition should further reinforce this segment.

Takeaways

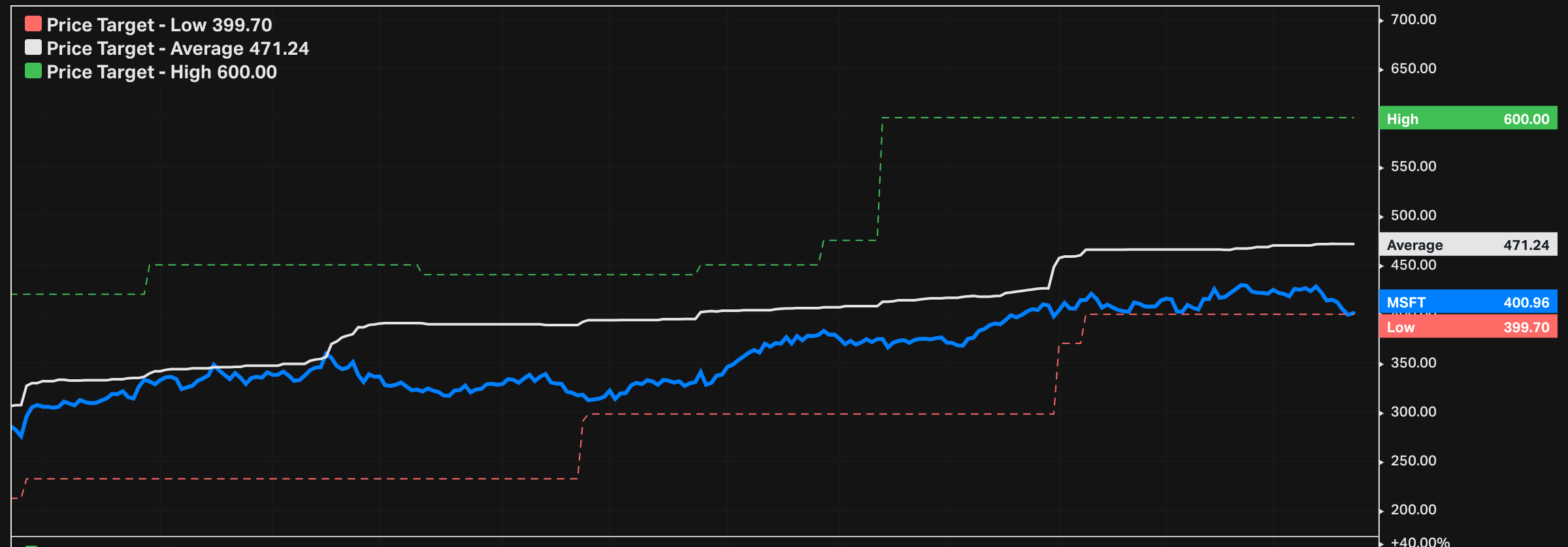

Expect a strong quarter for Microsoft but guidance is a risk on weakening macro and will set the stage for the rest of this quarter's earnings in software. Our price target is $478 which is just slightly higher than the median consensus estimate

Meta (META)

The metaverse strategy in my view has largely been a failure to date. Despite heavy investments and a strong push from the leadership, the metaverse has struggled to gain traction and deliver on its promises.

One of the main issues has been slow user adoption. Many users have found the experience underwhelming, with limited compelling content and a lack of clear use cases. The high costs associated with hardware and the technical limitations of current technology have also hindered widespread adoption. The metaverse initiative has been a drain on Meta's financial resources.

However, the big news is Meta has announced its decision to open-source the mixed-reality operating system that powers its Quest 3 and previous generations of Quest virtual reality headsets. Meta aims to broaden the ecosystem by inviting new partners to contribute to and build upon the existing platform. By sharing the source code with the developer community, Meta hopes to accelerate adoption and innovation and cultivate a developer ecosystem. This open-source approach could potentially lead to the creation of new applications, features, and hardware integrations, ultimately benefiting users and solidifying Meta's position as the leader in VR and AR.

This strategy is already yielding positive results with Meta's recent push into AI. The company's recently released Llama-3 model, an open-source large language model (LLM), has captured attention for its performance and potential applications. By cultivating an open-source ecosystem around its AI technologies, Meta is positioning itself as a leader in the field and attracting developer talent.

The success of Meta's AI initiatives is particularly evident in the potential threat it poses to Google's core businesses. A somewhat obvious move would be AI-augmented search, where Meta could potentially challenge Google's dominance. AI-based search leverages the power of LLMs like Llama-3 to provide more accurate and contextually relevant search results, potentially offering a superior user experience compared to traditional search engines.

As Meta continues to refine its AI technologies and integrate them across its platforms, the company could see significant improvements in user engagement, ad performance, and the development of new products and services. The potential applications of AI extend beyond search, with opportunities in personalization, content creation, and automation.

Takeaway

While Meta's metaverse strategy has largely been a failure, the company's pivot towards AI is showing promising early results. The success of the Llama-3 model and the cultivation of an open-source AI ecosystem demonstrate Meta's potential to become a major player in the AI industry. We had META into earnings last quarter and will again this quarter. However, I do see a risk to revenue, earnings, and guidance due to weaker macro. Our price target is $541 versus street consensus median of $481, but our position size is considerably reduced from last quarter.

Alphabet (GOOGL)

I have written much recently about Google's AI strategy, and I maintain my view that Google harbors significant technical advantages in AI which have yet to be productized across the portfolio. However, the company's failure to execute in the last two quarters, together with a weakening macro view for online advertising, and potential existential threat to Google's core search business are cause for concern. This is a defining moment for Google, and I think the sleeper has awakened. It will take time for management to create a sense of urgency and purge toxic cultural distractions, but time is no longer a luxury Alphabet has:

- Challenges in Corporate Culture and Execution: Recent events highlight significant internal challenges at Google, including a protest staged by employees that led to arrests and a sit-in at Google Cloud CEO’s office, indicating a potentially disruptive work culture. These events underscore tensions within the company regarding its contracts and the ethical implications of its technology projects.

- Bias and Errors in AI Implementations: The bias exhibited in Google's Gemini AI tool has raised serious concerns about the company's AI technology. CEO Sundar Pichai acknowledged these shortcomings, describing them as unacceptable and detailing the company's commitment to making structural changes and implementing rigorous evaluation processes to address these issues effectively.

- Commitment to Strategic AI Development: Despite these challenges, Google remains committed to advancing its AI capabilities, with Pichai emphasizing ongoing improvements and the continuation of the AI roadmap. This commitment indicates Google's focus on maintaining its competitive edge and leadership in AI innovation, despite internal and external hurdles.

- Management Guidance: During the Q4 2022 earnings call, Alphabet CFO Ruth Porat noted that the company saw a slowdown in search revenue growth, particularly in the second half of the quarter. This slowdown was attributed to a combination of factors, including a challenging macroeconomic environment, reduced advertiser spending, and increased competition in the search market. As a result of these challenges, Alphabet provided a more conservative outlook for Q1 2023, suggesting that the company expected the slowdown in search revenue growth to persist in the near term

Takeaway

We are either about to witness the awakening and rebirth of one of tech's greatest companies, a tale that will be retold for a generation, or a brutal slide into irrelevance as Google is finally overtaken by Microsoft and Meta. Recent signs of management seriousness and a foray into open source AI are reasons to be optimistic. I think this quarter is a risk of being another disappointment in the forward looking guidance for Google's core search business. I think Google's current state is priced in. Although our longer term price target is $183 versus street consensus median of $166, I expect this earnings report to be within the expected move of +- 5% given Google Cloud Next just concluded.

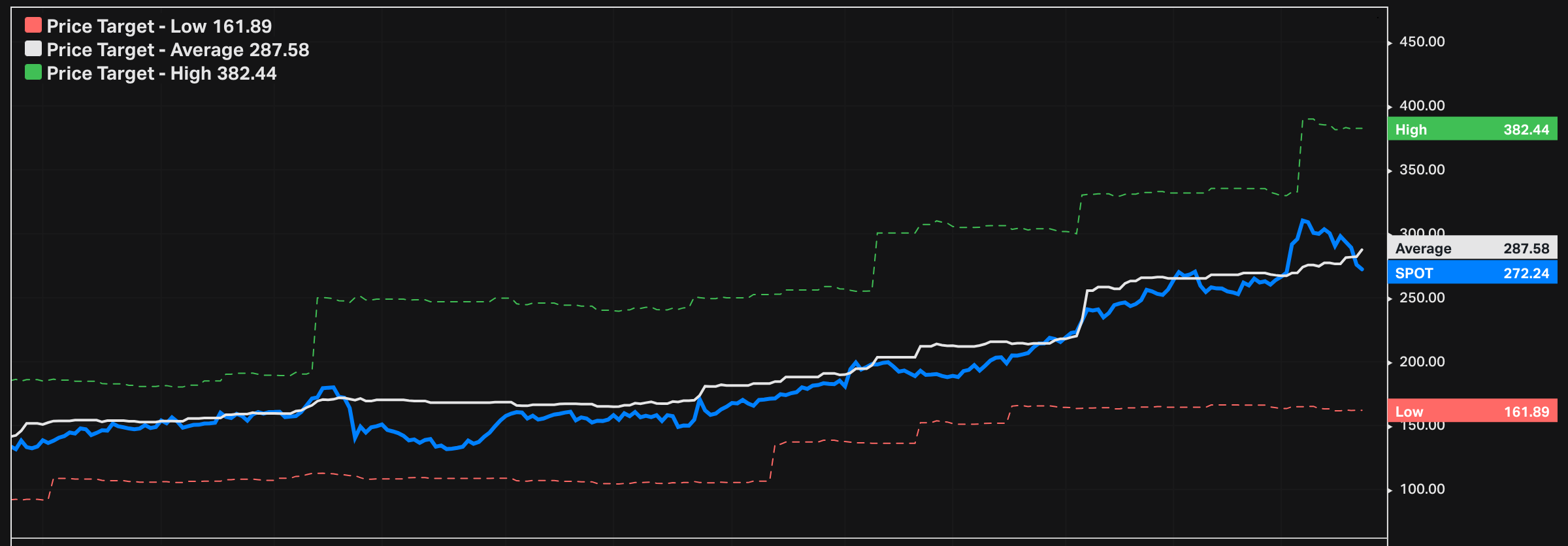

Spotify ($SPOT)

Spotify showed strong growth in Q4 2023, with significant increases in Monthly Active Users (MAU) and premium subscribers, alongside a revenue rise facilitated by new pricing strategies. The company is emphasizing profitability and efficiency, marked by its successful expansion into audiobooks and a near-profitable podcast segment. Moving forward, Spotify plans to balance user growth with enhanced monetization efforts, suggesting a positive outlook for its upcoming earnings.

For the first quarter of 2024, the company forecasts the following:

- Monthly Active Users (MAU): Expected to reach 618 million, an increase of 16 million from Q4 2023.

- Subscribers: Anticipated to rise to 230 million, up by 3 million from the previous quarter.

- Revenue: Projected to grow at a currency-neutral rate of 20% year-on-year, targeting around €3.6 billion.

- Gross Margin: Expected to be about 26.4%.

- Operating Profit: Estimated to be around €180 million.

Takeaway

I expect the report to meet management guidance. Given the recent selling, we have a small spread position targeting a move of +5% or better or alternatively -7% or worse, and the spread will likely be a loser between that range. Our target is $284-$295 on the print Tuesday morning.

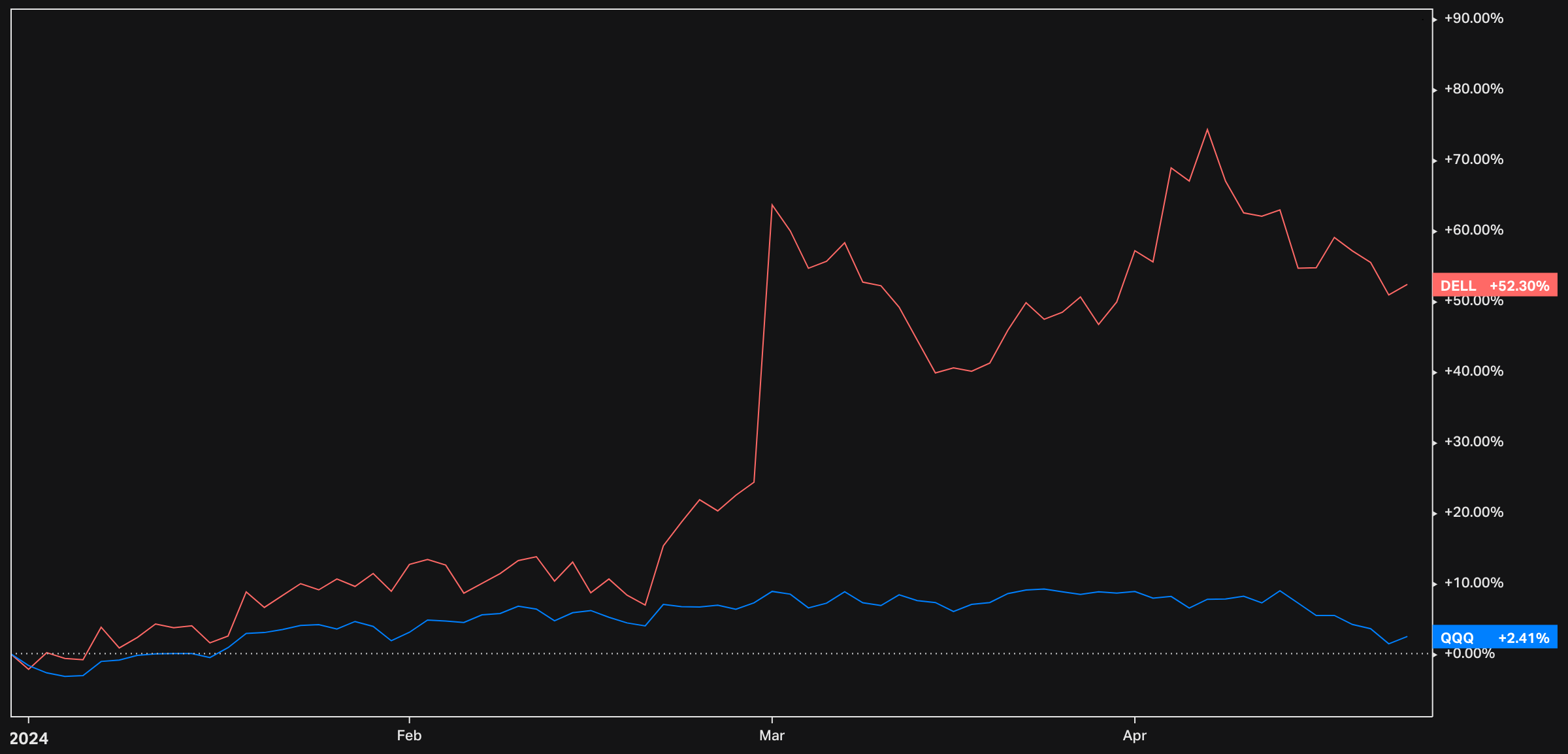

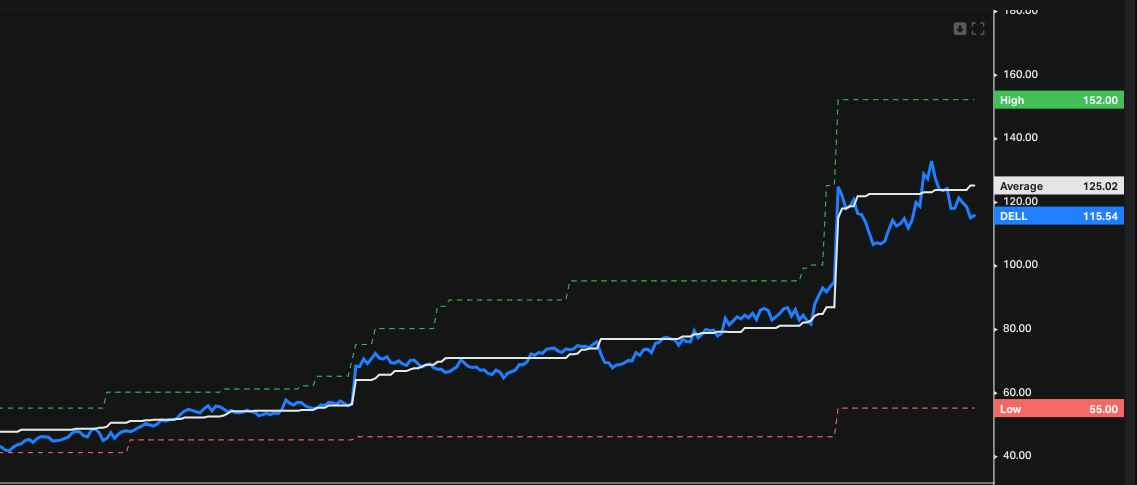

Dell

Dell, my former employer and acquirer of years past, is doing very well this year driven by AI and infrastructure spending, up over 52% YTD. Dell is scheduled to report earnings May 30th, 2024 (after-market). From the recent analyst conference and last quarter's earnings call, a few key points stand out:

- Strong Financial Performance in FY '24: Dell reported $88.4 billion in revenue with an EPS of $7.13 and cash flow from operations amounting to $8.7 billion.

- Optimism for FY '25: Dell has a growing AI backlog valued at $2.9 billion. They have guided for revenue growth of about 5% and EPS growth of 5% for FY '25.

- AI and Server Market Growth: A key part of Dell's strategy involves capitalizing on the expanding AI market. The company highlighted consistent growth in traditional server sectors and burgeoning growth in AI-optimized servers.

Takeaway

The gas has come out of semiconductors like NVDA, SMCI, and ARM in the last two weeks. I think there's the chance for further upside revisions to Dell, because recent developments in Google Small Language Models (SLMs) and Meta's Llama-3 could accelerate projects in the enterprise this quarter. Right now, I think Dell is already at our target of $115, but I'll be watching closely for evidence of AI projects moving forward this quarter.

In Case You Missed It

My recent article in VentureBeat discussing the developments in Small Language Models (SLMs) and why they matter to enterprise AI.